Planning for the future is not just about personal financial security; it’s also about ensuring a secure future for your loved ones. In this blog post, we will highlight the importance of estate planning, explain the benefits of trusts and how they work, and offer guidance on seeking legal advice for effective trust and estate planning. By understanding the significance of these steps, you can take control of your assets, minimize potential risks, and provide for your family’s well-being even after you’re gone.

- The Importance of Estate Planning: We will emphasize the importance of estate planning and the peace of mind it brings. Estate planning involves organising your affairs, documenting your wishes, and making provisions for the distribution of your assets upon your passing. We will explain how estate planning allows you to protect your wealth, minimize taxes, and ensure that your loved ones are taken care of according to your intentions.

- Explaining the Benefits of Trusts and How They Work: We will explore the benefits of incorporating trusts into your estate plan. Trusts offer numerous advantages, such as asset protection, avoiding probate, providing for minor or incapacitated beneficiaries, and maintaining privacy. We will explain the concept of a trust, its basic structure, and how it allows you to transfer assets to designated beneficiaries in a controlled and tax-efficient manner.

- Different Types of Trusts: We will provide an overview of different types of trusts commonly used in estate planning, such as revocable living trusts, irrevocable trusts, testamentary trusts, and special needs trusts. We will explain the specific purposes and benefits of each trust, helping readers understand which one might be appropriate for their unique circumstances.

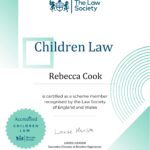

- Seeking Legal Advice for Effective Trust and Estate Planning: We will stress the importance of consulting with a solicitor who specialises in estate planning. A knowledgeable solicitor will guide you through the intricacies of trust and estate planning, ensure your documents are legally valid and comprehensive, and provide tailored advice based on your specific goals and family situation. They will help you navigate complex legal requirements and make informed decisions that align with your intentions.

- Regular Review and Updating: We will emphasize the need for regular review and updating of your estate plan. Life events such as marriage, divorce, the birth of a child, or changes in financial circumstances may require adjustments to your plan. We will encourage readers to work with their solicitor to review and update their estate plan periodically, ensuring it remains up to date and aligned with their current wishes.

Trust and estate planning is an essential part of securing a future for your loved ones and protecting your assets. By understanding the importance of estate planning, exploring the benefits of trusts, and seeking legal advice from an experienced solicitor, you can establish a comprehensive plan that provides for your family’s well-being and preserves your legacy. Remember, regular review and updating of your estate plan is crucial to ensure it reflects any changes in your life circumstances.